Investing, Finance, and Funding

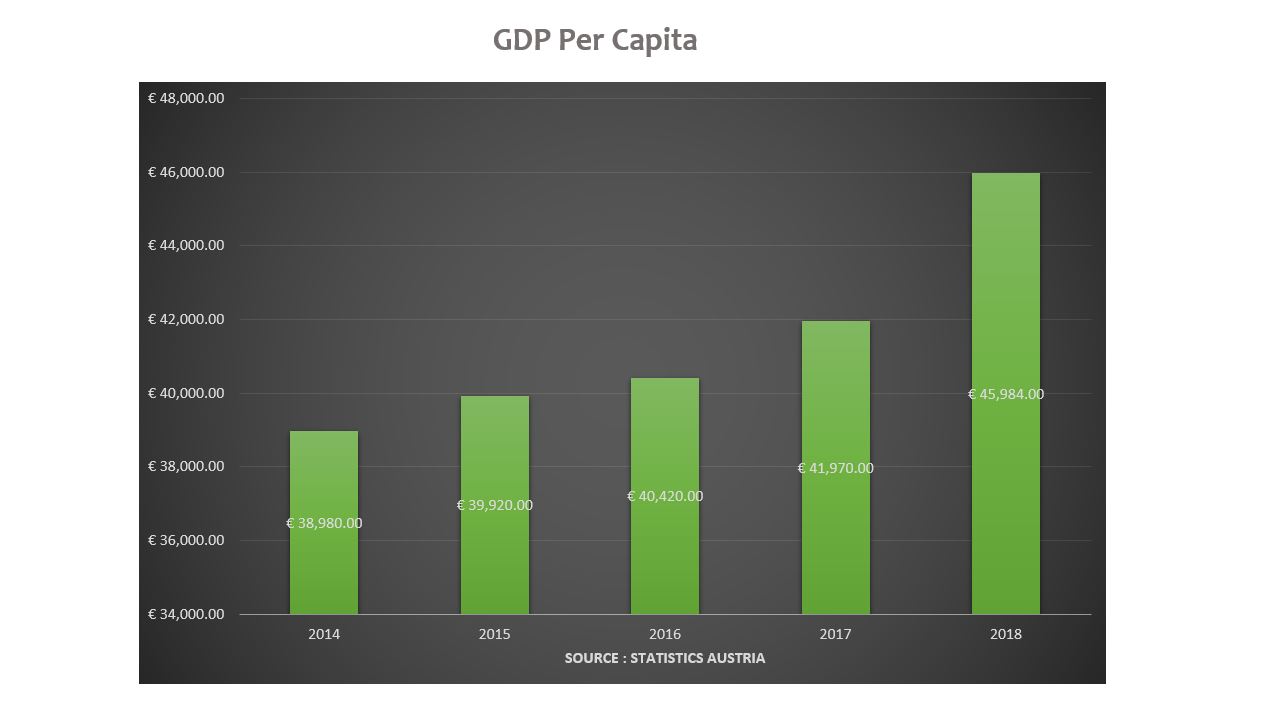

Austria is a country with highly favourable investment and financing conditions.

From 2017 to 2018 there was a 63% increase in invested money from 145 million to 237 million. In 2017, about EUR 25 million were invested via crowdinvesting (CrowdCircus market statistics); and no later than the first half of 2018, crowdinvesting had already surpassed more than 2/3 of the previous year’s volume. Also, total investment amounts for larger funding rounds (above € 2 million) grew faster than smaller funding deals below 2 million.

Access to finance isn’t a problem either for Austrian SMEs, as only 6.2% of domestic respondents considered financing to be an actual problem. This means that Austrian SMEs are doing just as well -if not better- than other European SMEs as far as financing is concerned.Austrian SMEs finance their assets mostly by debt, with their average equity ratio being 30.4% in 2016. Specifically, microfirms, small firms and medium-sized firms have average equity ratios of 23%, 28% and 33%, respectively. As far as debt funding is concerned, banks in Austria have not succumbed to the crisis as much as banks in other countries regarding the provision of loans to SMEs.

The public funding landscape in Austria is the second best in Europe, with a research intensity (% of the national GDP invested in R&D) of 3.19%. Additionally, public funding programmes account for a very substantial part of the 12.8 billion EUR that is expected to be spent on R&D in 2019. Due to Austria’s political structure, these programs are administered through both regional and national offering a satisfactory variety of funding sources.

Finally, the Austrian Angel Investors Association (AAIA), amongst other organizations, solidifies the fact that the support network of early stage inversors, incubators and business angels, is becoming more and more professional.

Regional Success/Characteristics

- high educational level

- multilinguistic environment

- strategic location – amongst Central European countries

- impressive purchasing power

- corporate openness to innovation and eagerness to cooperate with startups

- strong funding support and financing

- early stage investors

- efficient accelerators

- 14% tax credit for R&D incubators

- differentiated coworking spaces

- strong Angels

- for some projects, Austria operates as a “test” market for the german one

As far as Austria’s founders are concerned, 62% are aged between 25 and 39, 12% are women, 75% have a university degree and 14% come from abroad. Many of them are serial enterpreneurs and have already built up another company before their current attempt.

Moving to its cities and regions, arinthia has seen two large deals, Bitmovin and Symvaro, Styria is #2 in 2018 numbers of deals (12), while Upper Austria has seen a large number of smaller, earlier-stage investments.

Finally, let’s address Vienna. Vienna is a near perfect city to start a business in. Aside from the high quality of life and low living cost (in comparison to many other cities in Europe), sociopolitical stability, and top-notch services and infrastructure, it is the biggest University City amongst German and Central Eastern European countries, which means that it possesses a talent pool of young, bright and international people. Vienna raised the highest total of capital in 2018, making it possible for start-ups in Vienna to obtain around 50 milion Euros per year. Furthermore, every start-up gets exceptional free of charge support from the Vienna Business Agency – from settling down in the city, to technology related solutions, and a huge business network.

All of the above conditions led to many companies choosing Austria as their start-up location. In this list you can see some of the millionaire and multi-millionaire copmanies funded in Austria.

Austrian SMEs Compared to the Rest of European Union

Austrian SMEs tend to employ more people than European SMEs on average, of which 68.7% were employed in the private sector, a roughly similar amount as the EU average of 66.6%.

Their productivity is higher than the average EU SME productivity, as is their activity of VC firms. Judging from the activity of various VC, it is safe to say that there was no problem in raising new VC money for their second funding round, after their first successful fund.

In the start-up density ranking, Austria is close to Germany and ahead of the U.K. and France, even though the latter two have a higher VC-to-GDP ratio. This means that their average VC investment per start-up (portfolio company) could be remarkably higher. Thus, Austrian start-ups may start from a rather modest level, given the small size of their initial market, whereas French and U.K. start-ups can start with an initial (national) market almost ten times the size of the Austrian one.

Start-ups and Available Programmes

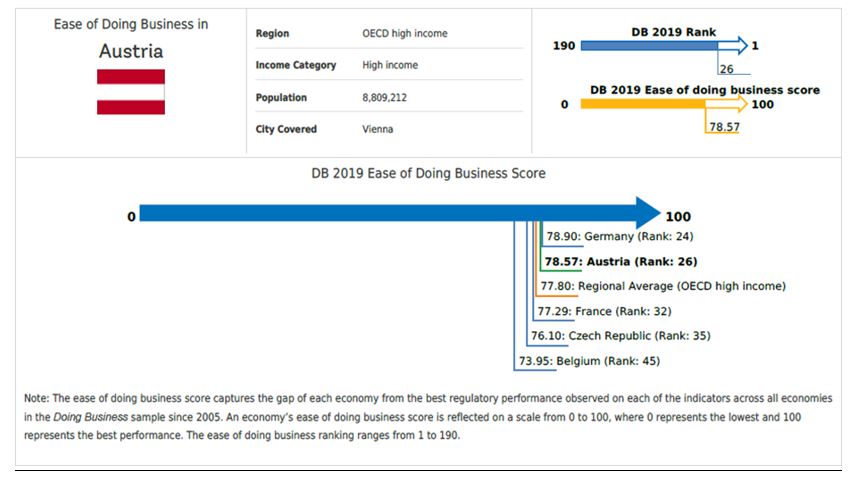

Austria has cemented itself as one of the top countries for startup companies through many measures that it has taken, in the following business aspects:

- Starting a Business: Reduction of the minimun capital requirement, which led to the reduction of the paid-in minimum capital requirement, and the lowering of notary fees.

- Registering Property: Requirement of online submission of all applications to register property transfers.

- Trading Across Borders: Introduction of an electronic customs clearance system and a risk-based inspection system.

- Enforcing Contacts: Electronic filing was made mandatory in civil matters and consequentially increased the efficiency of proceedings.

- Resolving Insolvency: A new law passed that simplifies restructuring proceedings and gives preferential consideration to the interests of the debtors.

Austria possesses a variety of Startup Programmes, namely:

AGRO INNOVATION LAB (BayWa & RWA), which targets teams who are working on argriculture-related innovative technologies, products and solutions.

ANDRITZ VENTURES, which targets start-ups that have developed a ready-to-market product or technology in the fields of industrial Internet of Things (IoT).

CREATORS EXPEDITION – An AVL Initiative, which targets startups in the technological areas of Electrical Mobility & Alternative Fuels, Autonomous Driving, Artificial Intelligence.

ELEVATOR LAB (Raiffeisen Bank), an acceleration programme for innovative FinTech start-ups.

IBM GLOBAL ENTERPRENEUR, which targets startups with products associated with Data, IoT, AI technologies, Blockchain, etc.

SALZBURG AG INNOVATION CHALLENGES, which targets startups with innovative ideas on the fields of Energy, Transport, and Telecommunications.

VIENNA BUSINESS AGENCY, which targets startups in the area of life sciences, urban technologies, creative industries and ICT.